Once again, Community Action Partnership of Madera County is participating in the Volunteer Income Tax Assistance (VITA) program. The VITA Program offers free tax help to people who generally make $66,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

Once again, Community Action Partnership of Madera County is participating in the Volunteer Income Tax Assistance (VITA) program. The VITA Program offers free tax help to people who generally make $66,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

Due to the COVID-19 virus we are asking clients to wear a face covering and maintain social distancing at CAPMC VITA. Once taxpayers sign in, provide a contact cell phone number, and have the necessary paperwork to complete, they will wait outside or in their cars until it is time to meet with the tax preparer volunteer. No children should accompany taxpayers. If you have been in contact with a confirmed a case of COVID-19, feeling feverish or have chills, new or worsening cough, new or worsening shortness of breath, please stay home. Volunteers will be wearing protective face coverings, cleaning and disinfecting the work spaces between clients to ensure a safe environment for all.

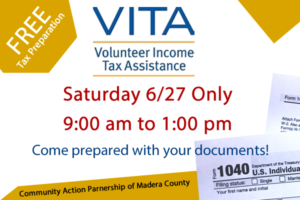

For more information, please see the VITA flyer in English or Spanish.

The VITA tax preparation assistance is provided on a First Come – First Serve basis. When you come for your VITA tax preparation, please be sure to bring the following documents:

- Proof of identification (photo ID)

- Social Security cards for you, your spouse and dependents

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

- Proof of foreign status, if applying for an ITIN

- Birth dates for you, your spouse and dependents on the tax return

- Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers

- Interest and dividend statements from banks (Forms 1099)

- Health Insurance Exemption Certificate, if received

- A copy of last year’s federal and state returns, if available

- Proof of bank account routing and account numbers for direct deposit such as a blank check

- If filing taxes as a married-filing-joint tax return, both spouses must be present to sign the required forms

- Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

- Forms 1095-A, B and C, Health Coverage Statements

- Copies of income transcripts from IRS and state, if applicable

Community Action Partnership of Madera County provides the VITA service in association with the following organizations: